Close to one third of all households (38 million) in the US live hand-to-mouth.

Like me, perhaps you have always assumed that a hand-to-mouth (HtM) household is low income. Spending all disposable income each week, the hand-to-mouth household is unable to save. Making its plight even worse, an emergency can send it into a tailspin because there are no reserves. For an HtM household, accessing $2,000 within 30 days is tough or even impossible.

A recent paper from 3 economists, 2 from Princeton and one from NYU, disagreed. In The Wealthy Hand-to-Mouth, these scholars estimate that two-thirds of all HtM households are actually somewhat affluent. However, since their wealth is tied up in a house, life insurance, a retirement fund, maybe even a boat, it is illiquid. Converting that asset to cash would have too great an opportunity cost. As a result, as with the poor HtM (P-HtM), their disposable income can be problematic.

With age as the x-axis, here are some characteristics of the HtM household (W-HtM is blue, P-HtM, red and Non-HtM is green):

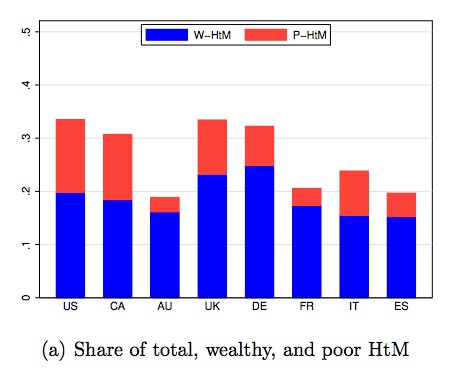

Here is the international comparison:

While HtM households can be investigated in countless ways, the authors of the current study had fiscal policy in mind. Reflecting a Keynesian outlook, they suggested targeting W-HtM households with a fiscal stimulus like a reduced payroll tax because they have a larger marginal propensity to consume (MPC) a proportion of any extra income. On the other hand, if you have a classical outlook, you will entirely disagree with the efficacy of the fiscal stimulus.

Here, so very excellently, in a little more than just 2 minutes, economist Justin Wolfers explains the possible fiscal connection between a stimulus and the W-HtM household.

Our bottom line? Rather like Benoit Mandelbrot’s fractal geometry, the closer you look at wealth and income, the more you see.

Sources and Resources: All facts and charts are from Brookings and The Wealthy Hand-To-Mouth.